Reliable Financing

Real Estate Investing. Made Easy.

If you are interested in learning more, please fill out the form

below we will reach out to answer any of your questions.

Investors across the country are building their real estate portfolios with Trueline Capital

248

Projects

Funded

$314.2MM

Capital

Deployed

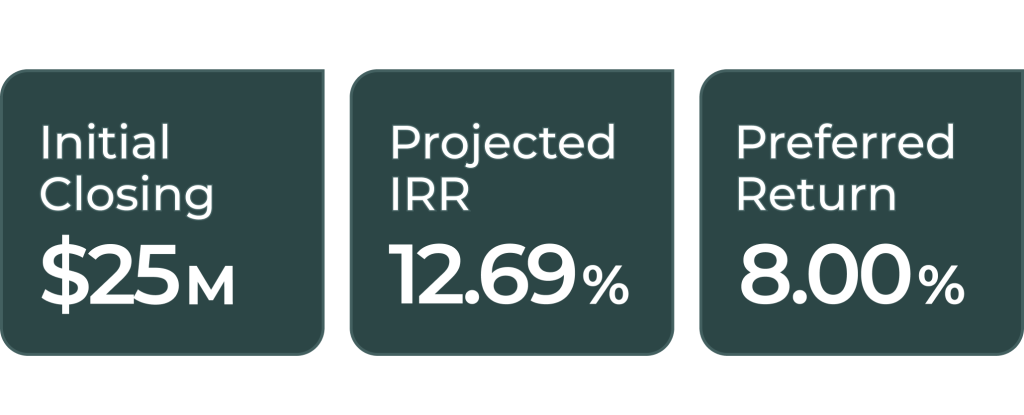

12.69%

Average Interest Rate

67%

Average Project

Loan-to-Value

Private Debt is Filling a Needed Void

Short-term debt investments in Trueline Capital Fund II & Fund III are perfectly positioned for our changing economic environment.

With banks continuing to hold capital due to rising scrutiny, private debt is perfectly positioned to fill the void while generating recurring income for investors through first-position liens. Since 2014, Trueline Capital has been originating and managing construction loans to regional homebuilders while generating attractive returns for hundreds of investors.

Asset Class

Attractive Yield

Consistency

Short Term

Hard Asset

Inflation Hedge

Cash on Cash Return

Average Annual Return*

Trueline Capital

Stocks

Commercial

Bonds

Gold

CD's

Invest With an Experienced Lender

Capital Preservation

Our top priority is to reduce repayment risk through conservative underwriting. Our target LTV of 65% safeguards our investment in the event property values drop 25%.

High-Yield

Residential construction loans generate high-yield income returns for investors.

Access to Niche Markets

Our fund provides access to niche or specialized credit markets that are not readily available to individual investors.

Limited Exposure

Construction Loans are short term 6-12 months, limiting exposure to market cycles and interest rates.

Diversification

Our Fund is structured to diversify originations and loans across builders, submarkets, and regions.

It's a Great Vehicle for Your IRA Investment

Look no further than investing your self-directed IRA in real estate. Real estate has historically appreciated over time, which is ideal for long-term investments, like our Fund which has historically had a 9.23% annualized IRR. Investing in real estate is also a great way of diversifying your investment portfolio and protecting yourself from stock market volatility.

Recently Funded Projects

Henderson

Tumwater, WA

Asset Type

SFR

Loan-To-Value

61%

Loan Amount

$912,000

Value

$1,500,000

Haller Lake

Seattle, WA

Asset Type

SFR

Loan-To-Value

75%

Loan Amount

$322,500

Value

$430,000

Stonebrook

Tacoma, WA

Asset Type

SFR

Loan-To-Value

71%

Loan Amount

$670,000

Value

$950,000

For Advisors

Unlock the Power of Real Estate Investment for Your Clients

-

Insights

-

Transparency

-

Ease

Your pathway to meaningful diversification for the portfolios you manage.

Ready to get started?

Invest today or get in touch with our team today.

Thank you for investing with Trueline Capital.